1. Overview of Malaysia

2. Overview of Malaysian Steel

3. Major steel companies in Malaysia

According to data from the Southeast Asia Iron and Steel Association, although Malaysia has a large number of steel mills, their scales are generally small. Apart from ten relatively large steel mills, the rest are small and medium-sized enterprises. Major steel companies include Lion Group, Ann Joo Steel Mills, China Steel Malaysia, Southern Steel Berhad, and Eastern Steel Malaysia, among others.

The Lion Group’s assets include two steel mills in Malaysia with an annual production capacity of 3 million tons, primarily manufacturing construction steel, wire rods, rebar, and other products. In 1978, the group obtained its operating license and became Malaysia’s largest steel producer. By 1985, after further expansion, its annual steel output exceeded 850,000 tons, solidifying its leading position in Malaysia’s steel industry. To date, The Lion Group’s steel mills account for over 60% of Malaysia’s total national steel production.

Established in 1971, Malaysia Steel Works is one of Malaysia’s largest steel mills and also one of the most important steel producers in Southeast Asia. The company mainly produces rebar, steel plates, steel pipes, as well as high-strength steel bars, low-carbon steel bars, and high-quality steel billets used in construction and infrastructure projects. Its annual production capacity reaches 1.5 million tons.

Founded in 1982, Eastern Steel is a steel mill primarily engaged in the production of steel plates and rebar. Located in Penang, Malaysia, it has an annual production capacity of over 3 million tons.

Established in 1961, ANNJOO is the first steel mill in Southeast Asia to have obtained three internationally recognized certifications simultaneously. It adopts a short-process integrated production method, combining smelting, rolling, and research & development. Its main products include steel billets, threaded pipes, low-carbon round steel, and steel bars—primarily long steel products widely used in construction and machinery manufacturing, and exported to Europe, the Middle East, the Far East, and other regions. Its annual production capacity reaches 2 million tons.

Alliance Steel (Malaysia) Group was established in April 2014 and is located in Kuantan, the capital of Pahang and the largest city in Malaysia’s East Coast Economic Region, near Kuantan Port. It is a joint venture steel company between Malaysian and Chinese enterprises.

With an annual production capacity of 1.5 million tons, Southern Steel is situated in the Klang and Prai regions of Malaysia. It produces a variety of high-quality steel products, including steel billets for hot rolling, industrial and construction wire rods, low-carbon steel round bars, and high-yield deformed steel bars for construction.

Founded in 1979, Melewar Steel is a steel mill primarily engaged in the production of steel plates and rebar. Located in Selangor, Malaysia, it has an annual production capacity of 1 million tons.

Established in 1997, Kinsteel is a steel mill mainly producing steel plates and rebar. Located in Selangor, Malaysia, it has an annual production capacity of 700,000 tons.

Founded in 1989, Malacca Steel is a steel mill primarily engaged in the production of steel plates and rebar. Located in Malacca, Malaysia, it has an annual production capacity of 500,000 tons.

4. Malaysian steel market demand

The construction industry has long been a key pillar of Malaysia’s steel sector, accounting for as much as 63%—making it the absolute largest consumer. It is followed by the metal processing industry and the electronics and semiconductor industries. The automotive industry is the primary user of high-end steel, with automakers such as Perodua and Proton driving demand. The home appliance and machinery manufacturing sectors are also seeing steady growth.

In Malaysia, the downstream applications of steel are primarily focused on property construction and automobile production, with strong demand for steel plates.

Malaysia’s per capita steel consumption remains lower than that of comparable countries, reflecting relatively slow growth in domestic demand. The Malaysian steel industry is composed of both private and state-owned enterprises and is heavily reliant on imported raw materials (compared to Indonesia, Malaysia lacks abundant reserves of key minerals such as nickel). Despite these challenges, the Malaysian government continues to prioritize the steel industry as a key component of its economic and infrastructure development.

On August 15, 2023, Malaysia’s Ministry of Investment, Trade and Industry (MITI) implemented a two-year moratorium on new steel investment approvals. This decision aims to address challenges within the industry and realign its direction with the National Industrial Master Plan 2030 (NIMP 2030). The moratorium covers all activities related to applications, permits, business diversification, and manufacturing, although exceptions may be made on a case-by-case basis for license applications that support the NIMP 2030 agenda.

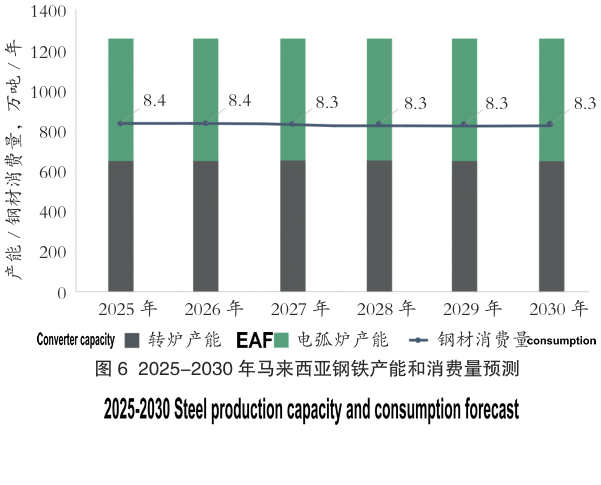

As a global hub for the semiconductor and electronics industries, Malaysia has seen continued growth in demand for related steel products, such as stainless steel. Looking ahead, with the advancement of the New Industrial Master Plan 2030, steel consumption in Malaysia is expected to maintain steady growth, reaching an estimated 8.6 million tonnes by 2025, with an average annual growth rate of about 3% over the next five years.

5. Import and export of Malaysian steel

In recent years, Malaysia’s steel exports have generally shown a growing trend. In 2024, the export volume reached 9.4 million tons, significantly higher than the 1.7 million tons in 2018 and surpassing the peak seen after the COVID-19 pandemic in 2020. Although the year-on-year growth rate of exports has slowed somewhat, the overall scale has been steadily expanding. Imports, on the other hand, have remained relatively stable, totaling 8.1 million tons in 2024. Since 2020, Malaysia has achieved a net steel export status for five consecutive years, with an initial structure of net exports taking shape. However, it is worth noting that the steel industry still maintains a high degree of external dependence, particularly with prominent structural imbalances in product variety.

On the import side, China is the largest source of steel for Malaysia, accounting for as much as 37%, nearly monopolizing 40% of the total import market. This is followed by Vietnam (12%), Japan (12%), Chinese Taipei (10%), and South Korea (10%), demonstrating a high dependency of the steel supply chain on East Asia. Other ASEAN countries also hold certain shares. This Asia-centric import pattern helps control transportation costs but also exposes risks associated with reliance on supply from specific regions.

6. Shortcomings of Malaysian Steel

The issue of structural imbalance in production capacity is particularly prominent. Currently, the output of long products (such as rebar and wire rod) accounts for as much as 83%, primarily serving the construction and infrastructure sectors. In contrast, flat products (such as hot-rolled, cold-rolled, and coated steel sheets) make up only 17%. However, industries such as manufacturing, electrical appliances, and automotive rely heavily on flat products, yet the rate of import substitution remains low. This has become a key bottleneck constraining the upgrading of the local manufacturing supply chain.

From a resource perspective, Malaysia’s BF-BOF (blast furnace–basic oxygen furnace) steel production mainly relies on domestically mined iron ore. The country’s annual iron ore output is around 6 million tons, most of which requires beneficiation before it can be used in steelmaking. In addition, Malaysia imports approximately 5 million tons of iron ore each year to meet domestic demand. Although Malaysia possesses small reserves of coking coal, the majority of its coking coal needs are still met through imports. On the other hand, Malaysia’s abundant bauxite and tin resources, among other auxiliary materials, provide a resource foundation for primary steel manufacturing.

Due to the lack of domestic iron ore resources, steel mills in Malaysia generally adopt the electric arc furnace (EAF) + continuous casting and rolling production route, using mainly scrap steel and HBI (hot briquetted iron) as raw materials, which offers significant advantages in energy conservation and emission reduction. In comparison, integrated steel mills with blast furnace–converter (BF-BOF) processes are extremely rare. At present, only United Steel and Eastern Steel possess blast furnace production lines.

The structure of “primary-level” exports and “high-end” imports reflects that Malaysia’s steel industry is still positioned in the mid-to-downstream segments of the industrial value chain and needs to extend further into high-end processing.

7. Advantages of Malaysian Steel

Malaysia’s steel industry benefits from significant geographical concentration, with major steel mills primarily located in the states of Pahang, Terengganu, Selangor, and Penang on the western Malay Peninsula, forming highly efficient synergies with key ports. Port Klang, the country’s largest trade port, supports the transportation of raw materials and products for steel mills in the Klang Valley region. Kuantan Port and Kemaman Port, situated near Hume Steel (United Steel) and Eastern Steel, serve as vital access points for blast furnace-based steel producers. Meanwhile, Johor Port and the Port of Tanjung Pelepas connect Singapore and international export markets, while Bintulu Port facilitates steel supply in East Malaysia.

Malaysia possesses abundant natural gas reserves, a fossil fuel that plays a central role in its economy as both a key industrial input and one of the country’s major export commodities. Countries such as the United States and Iran have leveraged their natural gas resources to advance Direct Reduced Iron (DRI) production, thereby developing steel industries with lower carbon emissions and more competitive pricing compared to Malaysia. Although the DRI-EAF (Electric Arc Furnace) route requires direct-reduced-grade iron ore, Malaysia has accessible magnetite deposits, which—in theory—could be processed with minimal beneficiation to produce direct-reduced-grade ore.

8. Challenges faced by Malaysian steel

9. Policy environment

more: https://www.sinosteel-pipe.com/en/overview-of-the-malaysian-steel-industry.html